Last reviewed 28 January 2025

Latest updates

28 January 2025 | All destinations reviewed and new rates for Hamburg from 1 January 2025 added.

Recent News

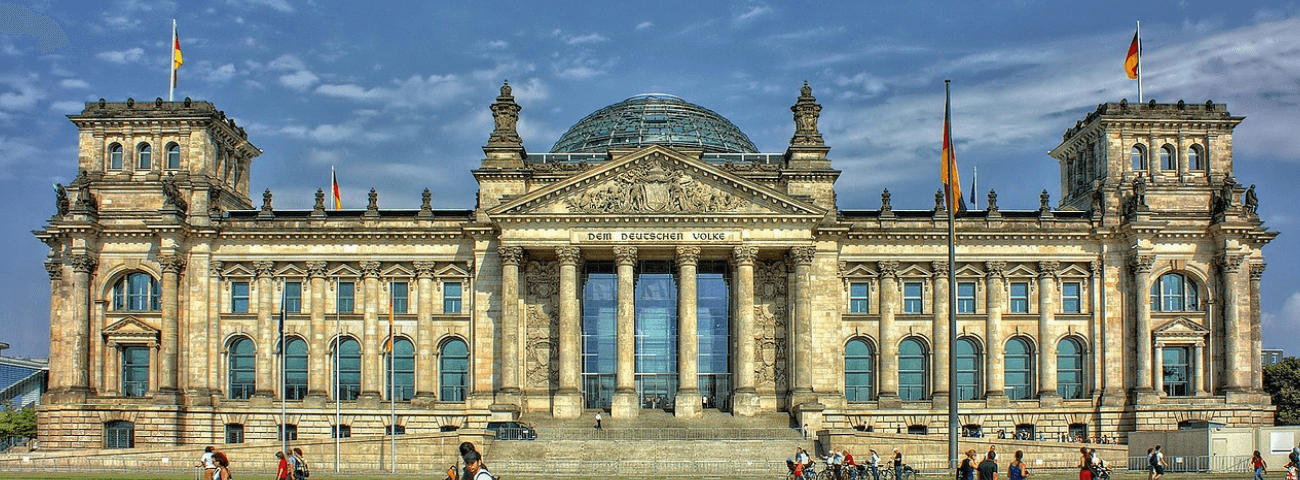

19 December 2024 | Berlin – The city tax has been approved to increase by 2.5% to 7.5% effective from 1 January 2025. Further information from Berlin hotel association DEHOGA on the changes including transitional arrangements.

Kurtaxe

The tourist tax (kurtaxe) is decided by local governments (municipalities) and is usually known as the accommodation tax (beherbergungsabgabe) or culture tax (kulturförderabgabe).

Munich does not currently levy a tourist tax as prevented by the Bavarian State Government. Munich’s proposal is 5% cost of room and are awaiting a Court ruling on whether Munich is permitted to implement. The spa fee and tourist tax currently in force applying in Bavarian health resorts is separate to Munich’s proposal.

Below are selected destinations and further information can be found by clicking on the name of the destination.

| Hotel Rates (no maximum nights unless stated) |

Net Cost of Room (excluding 7% VAT and breakfast) |

Gross Cost of Room (including 7% VAT, excluding breakfast) |

€ per person, per night | Some Exemptions |

| Baden Baden (Shortone 1)* (Shortone 2)* |

– | – | 3.80 1.70 |

Children under 18, Youth Hostels |

| Berlin | 7.5% | – | – | School trips |

| Bonn (max 21 nights) |

– | 6% | – | Children under 18, School trips |

| Bremen (max 7 nights) |

5% | – | – | Children under 18 |

| Cologne | – | 5% | – | School trips |

| Dortmund | – | 7.5% | – | – |

| Dresden | – | 6% | – | Children under 18 |

| Frankfurt | – | – | 2.00 | School trips |

| Leipzig | – | 5% | – | Children under 18 |

* Baden Baden

Shortone 1 – Area between Sinzheimer Straße / Ooser Hauptstrasse and Klosterplatz (Lichtental) / Schafbergstraße, and all secondary roads except the district Balg

Shortone 2 – Remaining urban areas

| € per person, per night |

Net Cost of Stay (excluding 7% VAT and breakfast) |

Some Exemptions | ||||||

| €0 – €10 |

€10.01 – €25 |

€25.01 -€50 | €50.01 -€100 | €100.01 -€150 | €150.01 -€200 | Above €200 | ||

| Hamburg | 0 | 0.60 | 1.20 | 2.40 | 3.60 | 4.80 | Increase by €1.20 for every further €50 | – |

Disclaimer: While best efforts have been made to verify the accuracy of the information, the information displayed should be used as guidance only.

Keep up to date with levy and tourism taxes – both actual and planned. Find out all about the Kurtaxe or visitor tax across Germany.

This content is exclusive to ETOA members

Not a member yet?

The ETOA membership opens invaluable networking opportunities to your business, allows you to gain access to critical insights and information and contributes to the campaign for a better regulatory environment in Europe.

- Connect with the global travel trade

- Stay informed of insights, regulations and changes

- Be supported in shaping the tourism landscape